Open topic with navigation

You are here: Reference > Table Details > Deferred Comp Plan Codes Table

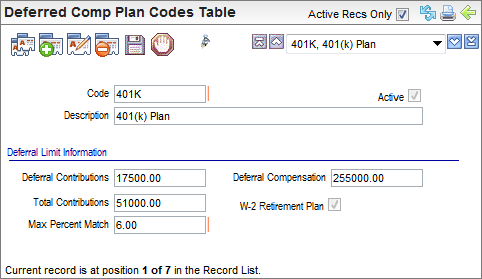

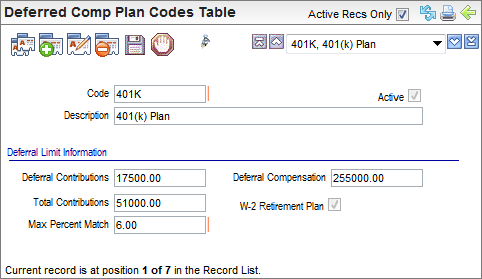

Deferred Comp Plan Codes Table

Overview

Overview

Deferred Comp Plan Code

Fields on the Deferred Compensation Plan Codes Table

- Code

(required). A

code of ten characters or less with no spaces or special characters. Use

the same code as is called by the payroll accumulator processing codes

and stored procedures that the plan will be using.

- Description

(required). Enter

a description of thirty characters or less for the code.

- Active? An

active code has the Active checkbox selected, making the code available

and keeping the code in effect as a valid choice. Inactivating any code

can result in records with the code selected having orphaned data.

Deferral Limit Information

Verify that the limits for the Deferral

Contributions, Total Contributions,

Deferral Compensation,

and Max (Employer) Percent Match, comply with the Federal

tax guidelines. If not, edit and assign the limits according to Federal

guidelines.

- Deferral

Contributions. The

total annual employee contribution allowed for this deferred compensation

plan code. Enter the limit for how much the employee can contribute per

year in the Deferral Contributions field. This field will limit how much

the employee can contribute.

For most deferred compensation plans, the limit

for Deferral Contributions is determined by regulatory guidelines and

changes annually.

For an employer-only pension plan without employee

contributions, enter 0.

- Total

Contributions. The

total employee and employer contributions allowed. Add together the amount

that any employee can contribute with the maximum amount that the employer

may contribute, and enter that amount in the Total Contributions field.

- Deferral

Compensation. Optionally,

you can enter the maximum earnings that the plan is calculated against

in the Deferral Compensation field. The Deferral Compensation entry will

not impact any calculations when standard system payroll accumulators

are used. A custom accumulator may be developed to include this limit

for a particular deduction.

- Max

(Employer) Percent Match. The maximum

employer match. If there is a maximum percentage to match,

enter it as a whole number in the Max Percent to Match field. For instance,

100% would be entered as 100.00. This field will limit the percentage

that the employer will match.

- W-2

Retirement Plan? If

this code will be used for a plan or deduction that complies with the

Federal specifications for a qualified retirement plan, select the W-2 Retirement Plan checkbox. For year-end,

the W-2 Retirement Plan indicator

determines if a deferred compensation is an eligible retirement plan.

Note: When a deferred compensation

plan is selected on a Deduction Code, the limits from the Deferred Comp

Plans Code transfer to all associated Employee Deduction Detail records,

and payroll processing updates the adjusted

limit per employee.