The system enables processing third-party sick payments throughout the year instead of as procedures at year-end. This became available with v5.5.110 and later versions.

The third-party sick wages are added to boxes 3 and 5 of the W-2 only if the earning to record these payments doesn't have the “Update EE Taxable Wages” checked – i.e. Processed payments did not update employee FICA/FHI taxable wages. The calculated employee Social Security tax on the Third Party Sick Pay wages is added to box 4. The calculated employee Medicare tax on the Third Party Sick Pay wages is added to box 6.

The Third-Party Sick Pay earning code must contain “THIRDPSICK” in the W2 box, as seen in the following figure. A specific Earning code value is not required for this.

Earnings Code with W-2 Box of THIRDPARTYSICK

Enter the employees Third-Party Sick Pay earnings through the payroll process as currently required.

When the 941 or W-2 is processed during Process Taxes, entries are automatically generated in the Employee Third Party Sick Detail.

|

Employee Third Party Sick Detail in Browse Details |

In Enterprise Client, this screen is often available from the Browse Details tab as “Third Party Sick Detail”. No web access to this new detail is available. These details are per quarter end date.

Third Party Sick Pay Detail for 1st Quarter |

|

You cannot manually add records for employee third-party sick payments. You can only modify the FICA Tax amount and FHI Tax amount on generated entries. If you modify these entries and wish to save your changes, please be sure to check the “Manual Edit – NO DELETE” box so future 941 tax processing does not delete and re-create these manually edited records. However, note that if the Third Party Payments amount changes from the existing record value to what is calculated during current tax processing of the quarter, future tax processing will delete these records – regardless if you check the manual edit box or not. The system payroll tax processing contains processing specifically for the processing of employee FICA taxes. The system uses the employee's year-to-date taxable wages and reported third-party sick payments when evaluating the tax processing wage limit. If the combination of these wage amounts exceed the tax wage limit value, then no taxes process. With this in mind, it is important to remember to process 941 taxes immediately after payrolls are posted that record employee third-party sick payments so proper entries will be automatically generated in the employee Third Party Sick detail table and related screen. |

Third Party Sick Pay Detail for 2nd Quarter |

|

Third Party Sick Pay Detail for 3rd Quarter Employee Third Party Sick Pay Detail for Fourth Quarter |

See the following illustrations for sample employee with both regular and Third Party Sick pay wages.

Payroll Reporting of REGULAR and THIRDPARTY Sick Earnings

Results on Re-Processed W-2s

W-2 Audit Information Including Third Party Sick Pay

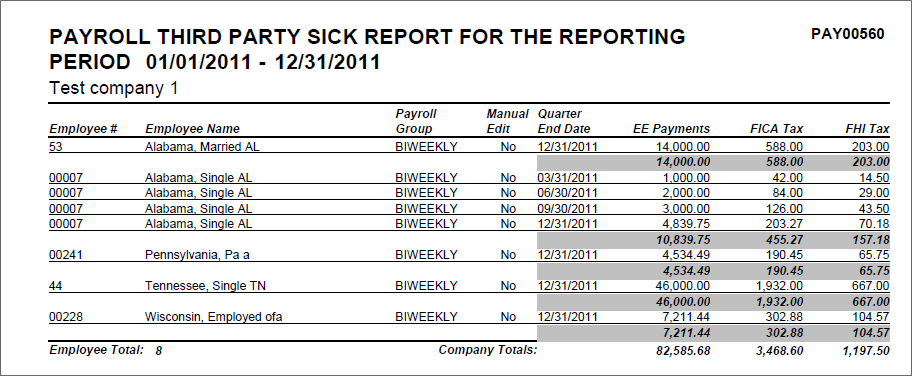

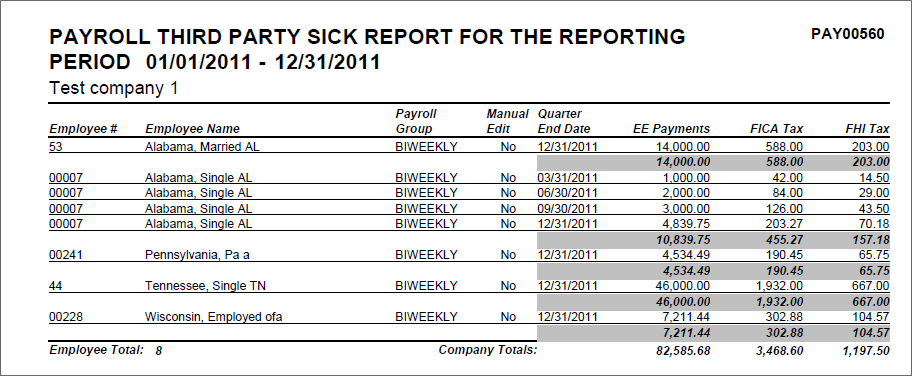

The PAY00560 report, Payroll Third Party Sick for the Reporting Period, lists employee third-party sick payment record information.

PAY00560, Payroll Third Party Sick Report