Open topic with navigation

You are here: Reporting > Payroll Reports > Payroll Reports > Web Payroll Process Report

Web Payroll Process Report

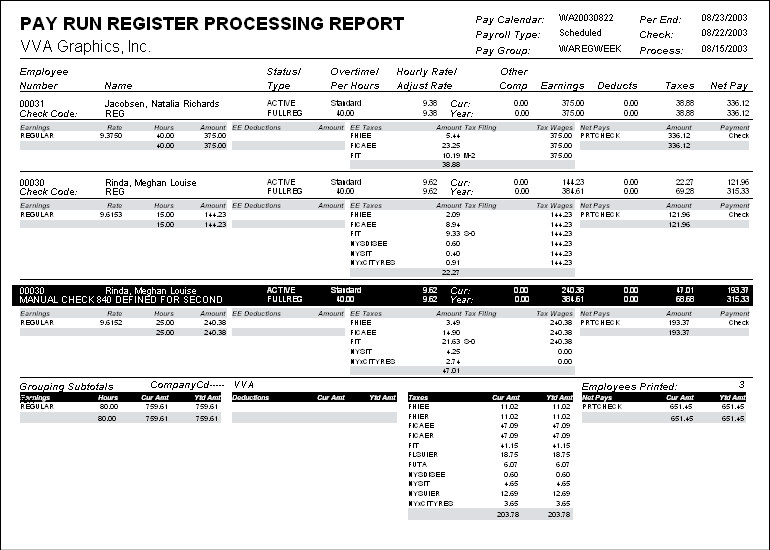

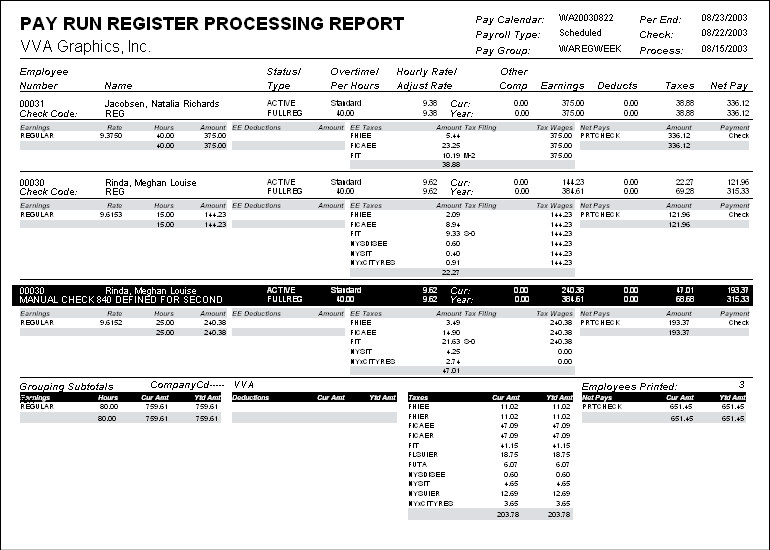

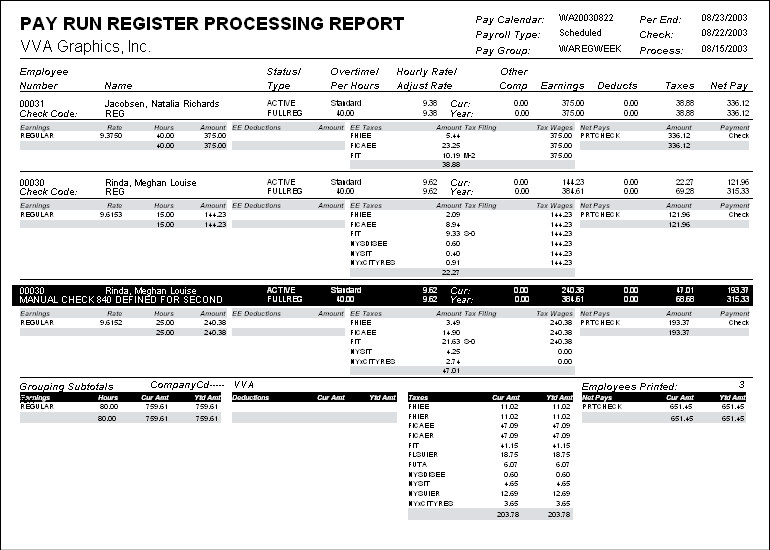

The Payroll Process Report, WEB00505,

is the key report for payroll funding, payment liabilities, and all other

banking transactions associated with the payroll. All tax liabilities

and what liabilities that were escrowed and when they will be paid are

included. This is the most popular overall payroll report and balancing

report.

Business Scenario

The Payroll Process Report is used in the balancing and reconciling

of check and ACH transactions for a given payroll. This report may also

be used as the supporting documentation for the ACH file processing for

the payroll.

Payroll Process Report, WEB00505

The Payroll Process Report details all banking transactions,

both ACH and check payments, created in a payroll process. These banking

transactions include the following:

- Gross payroll & tax funding

summarizes Gross pay, employer taxes, employer deductions and the service

fee payment.

- Direct payroll payments and funding

totals employee checks, employee ACH advices and vendor, tax and fee payments.

- The Tax liability summary details

the total taxes by tax code and broken down between employee and employer.

- The Payroll deduction vendor

and tax agency direct and escrowed payments details these payments by

vendor/Agency, it includes the payment date and the payment due date of

escrowed payments. It also references the bank accounts being debited

and Vendors and/or agencies being credited in the payroll process.

- Manual and Void payments details

the manual and/or voided checks processed within a payroll process.