Open topic with navigation

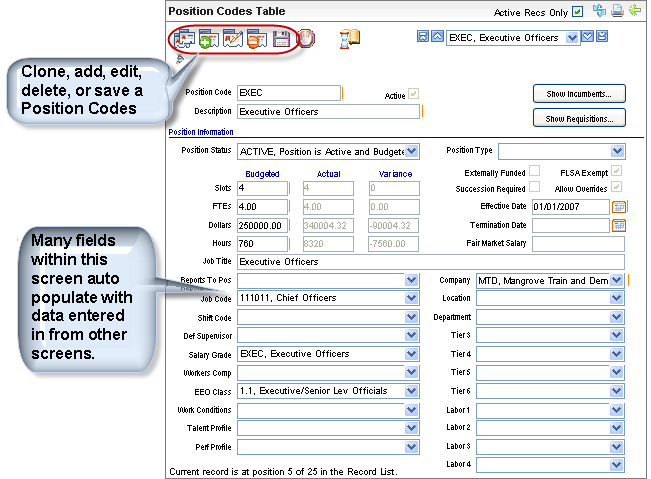

Position Codes Table

Overview

Overview

Online View

Position Code (Example)

For budget control of pay, position control sets and maintains

a budget per position. Per Position code on the Position

Codes Table, the dollars for calculations

of budgeted, actual, and variance dollars.

Fields on the Position Codes Table

- Position Code (required).

Enter a

Code of ten characters or less. Unlike most other validation table codes,

hyphens and periods may be entered in the Code field on the Position Codes

Table.

- Description

(required). Enter

a Description of thirty characters or less.

- Active?

An

active code has the Active checkbox selected, making the code available

and keeping the code in effect as a valid choice.

- Show Incumbents. While

working on staffing levels, view a list of employees assigned to the position

through the through the Show Incumbents

button.

- Show

Requisitions. View

a list of candidates for any requisitions for this position through the

"Show Requisitions" button. View a list of candidates

for any requisitions) for this position through the "Show Candidates"

button.

Position Information

- Position

Status. Select the Position

Status code that best represents the new position code status from

the available status codes.

Budgeted, Actual,

and Variance Columns

The grid for Budgeted, Actual, and Variance, is for budgeting.

In this section, each column is defined, and the next section of this

topic defines each row.

- Budgeted.

Fields

completed under the Budgeted column

represent the planned, budgeted amount. Complete the fields in the Budgeted

column: Slots, FTEs, Dollars, and Hours.

- Actual.

Fields

completed under the Actual column

represent actual amounts and are computed automatically using information

stored in the Employee Master's Compensation and Assignment tabs and Position

Details. Review the Actual values for Slots, FTEs, Dollars, and Hours.

If no employee is currently assigned to the position, then the Actual

column remains blank when the record is saved.

- Variance.

Any variance

between the budgeted and actual amounts automatically displays in the

Variance column. Review the Variance

values for Slots, FTEs, Dollars, and Hours.

Budgeted, Actual, and Variance Rows

Complete the fields in the Budgeted

column: Slots, FTEs,

Dollars, and Hours.

Review the system-generated Actual and

Variance entries for Slots,

FTEs, Dollars,

and Hours.

- Slots.

Define

the number of budgeted Slots for

this position in the Slots budgeted field. This is the number of people

who can have this position at the same time. Often this is the same as

the number of FTEs (Full Time Equivalent positions), but for positions

that are held part-time, the number of Slots may be greater than the number

of FTEs.

- FTEs.

Define

the number of FTEs (Full Time

Equivalent positions) for this position in the FTEs budgeted field. The

FTEs are used as a basis for

determining Budget Dollars and Hours.

For instance, a company may have 5 FTEs for

a particular position code that is half-time, and may have 10 Slots (and

employees) to fill that position.

- Dollars.

Enter the

number of budgeted Dollars. The

Dollars field is based on the number of FTEs and the Payroll Mode.

For instance, if a position has 2 FTEs and the Payroll Mode

is BIWEEKLY (Bi-Weekly Payroll with Bi-Weekly Pay Amount), then a position

paying $800.00 bi-weekly needs 1600.0 budgeted dollars, which is 2 x $800.00.

- Hours.

Enter the

budgeted number of Hours. Determine

the entry needed in the Hours

field based on the number of FTEs

and the Payroll Mode.

For instance, if a position has 2 FTEs and a Payroll Mode

of BIWEEKLY (Bi-Weekly Payroll with Bi-Weekly Pay Amount), typically the

correct entry for budgeted Hours would be 160.00, which is 2 x 80 hours

in a bi-weekly pay period.

Actual and variance amounts display based on employees

who are assigned to the position code that is being viewed.

Position Information,

Right Column

- Job

Title (optional). Enter

a job title.

- Reports

to Pos (optional). What

position does this position report to?

- Job

Code. Select

an associated Job Code.

- Shift

Code. Select

an associated Shift Code (if applicable).

- Def

Supervisor. The

default supervisor. Assigned direct Supervisor for this position for reference

purposes. This can be used to look up which position typically reports

to which supervisor. (In previous versions, this was assigned on the Job

Code.) The

actual supervisor assignments are per employee on employee records.

- Salary

Grade (optional). The

salary grade code to associate with this job for later determination of

compensation ratios per employee.

- Workers

Comp (optional). Select

the Workers Comp classification from the Workers Compensation

Rates Table.

- Work

Conditions (optional).

Select

the working condition code, if applicable. (In previous versions, this

was assigned on the Job Code.)

- Talent

Profile. Talent

profile for performance management. This field is reserved for use with

future functionality.

- Perf

Profile. Performance

profile for performance management. This field is reserved for use with

future functionality.

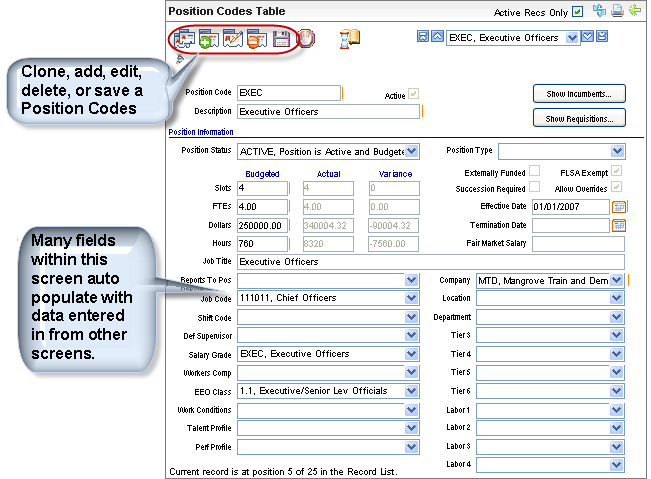

Position Information, Right Column

- Externally

Funded? If

funding for this position is derived from a source outside the company,

select the Externally Funded checkbox.

- FLSA

Exempt Position? If

the checkbox for FLSA Exempt Position

is selected, this Position Code is considered an FLSA

Exempt position. Also look at this value on the Employee Master.

- Succession

Required? If

succession planning is required for a position, select the checkbox for

Succession Required.

- Allow

Overrides? If

actual assignments may vary from the Position assignments defined on the

Employee Position Detail, then select the checkbox for Allow Overrides.

Allowing overrides permits.

- Effective

Date (required). Complete

the Effective Date field with

the date the position code became or becomes effective.

- Terminated

Date. If

a position code is terminated, enter a Terminated

Date. To indicate that an existing position is being phased out,

a future termination date can be entered.

- Fair

Market Salary (optional).

The fair

market salary can be entered. Omit the dollar sign.

At a future date, if a position is terminated,

return to the Position Codes Table and edit the corresponding Position

Code.

Labor Segments

- Company

(required). Select

the associated Company Code.

- Location

(optional). Select

the Location code.

- Department (optional).

Select

the Department code.

- Tier

3 (optional). Select

the Tier 3 code.

- Tier

4 (optional). Select

the Tier 4 code.

- Tier

5 (optional). Select

the Tier 5 code.

- Tier

6 (optional). Select

the Tier 6 code.

- Labor

1 (optional). Select

a Labor Segment 1 code for the

standard labor distribution for this position code. This labor distribution

information is overridden by the information defined on the employee-level

and defined per payroll.

Note: The

SPLIT Labor Segment 1 Code is normally reserved for use during detailed

pay entry. However, on an Employee Position Detail, a Labor Segment 1

of SPLIT can be selected to keep a corresponding Employee Pay Rate Detail

from being created.

- Labor

2, 3, and 4 (optional).

Select Labor Segment Codes 2-4

as appropriate to define a standard labor distribution for this position

code. This labor distribution information is overridden by the information

defined on the employee-level and per payroll.