Open topic with navigation

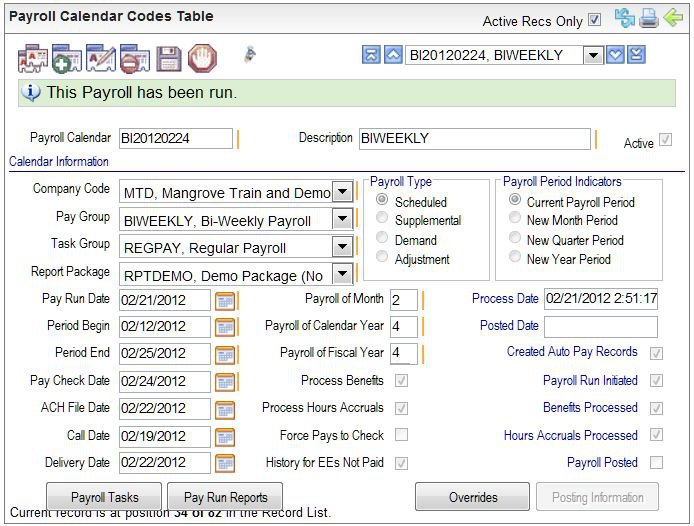

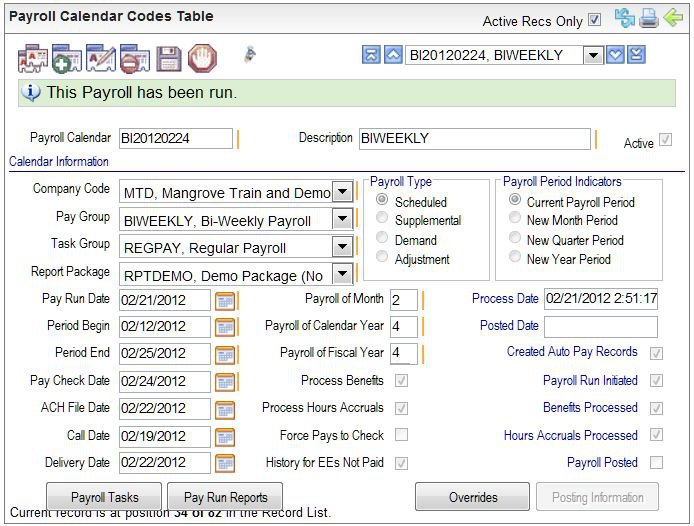

Payroll Calendar Codes Table

Overview

Overview

Payroll Calendar

This table is view-only via the web-product.

When

the payroll is in a Gross-to-Net status (after Gross-to-Net processing),

information under the toolbar emphasizes: "This Payroll has been

run." When a payroll has been posted, that posted status information

shows: "This Payroll has been posted."

Several buttons are available depending on

whether the payroll is posted or un-posted. See the "Buttons"

section of this topic.

Fields on

the Payroll Calendar Codes Table

- Payroll

Calendar (required). A

code to identify the payroll calendar.

- Description. A

text description of thirty characters or less.

- Active?

An

active code has the Active checkbox selected, making the code available

and keeping the code in effect as a valid choice.

- Company (required). The

Company Code to be paid and designated for reporting this payroll's information.

- Pay

Group (required).

The set

of employees to be paid by this payroll run.

- Payroll

Task Group. The

set of system-processing conventions for payroll processing. Each

Payroll Task Group includes payroll processing task items, such as Gross-to-Net processing and

Posting Payroll.

- Report

Package. The

set of reports that can be automatically produced from Enterprise Client

or Enterprise Manager.

Enter dates in MM/DD/YYYY

format.

- Pay

Run Date. The

projected date of the actual payroll run.

- Period

Begin. The

first day of the payroll period when hours worked begin to apply to this

pay run.

- Period

End. The

last day of the payroll period, the final day that hours apply to this

pay run.

The begin and end dates of the payroll period work in conjunction

with the effective beginning and ending dates of items to determine what

processes for a pay run for this Payroll

Calendar Id.

- Pay

Check Date. The

date recorded on the payroll disbursement forms. The check date impacts

taxation. For instance, a check date on 12/31/2012 is taxable and reportable

for 2012, and a check date on 01/01/2013 is taxable and reportable for

2013.

The Process Date

and Posted Date automatically

populate when the payroll is processed and posted.

- Process

Date. The

Process Date is automatically updated when the payroll is processed to

gross-to-net. This is the day that the payroll is submitted for processing.

- Posted

Date. The

Posted Date is automatically updated when the payroll is posted. Posting

is also known as finalizing or final payroll posting.

- ACH

File Date. The

ACH File Date is the date the

ACH should be created. The ACH File

Date is unlike the actual Settlement

Date that can be entered when the ACH is processed.

- Call

Date. The

Call Date is the date by which

the Payroll Department or Processor needs to have received all Payroll

information including time and expenses.

- Delivery

Date. The Delivery Date

is when the completed Payroll including any employee checks or paper reports

need to be delivered.

- Payroll

Type. Confirm or choose the Payroll Type to define the taxation

and details considered in the pay run: Scheduled, Supplemental,

Demand, or

Adjustment Payroll Run.

Scheduled. A

regular payroll run is a Scheduled

run. A scheduled payroll run needs to be processed on or before the check

date. A scheduled payroll run with direct deposits or ACH processing needs

to be processed before the number of days due prior to settlement for

the Originating Bank code.

Supplemental. The

Supplemental option taxes earnings

at the Supplemental Rate. It also looks at the deductions and taxes to

determine if they are to be included in a Supplemental run.

Adjustment. The

Adjustment runs process taxes

using daily tax calculations. Currently, payrolls processed with the Adjustment

type aren't included on the online paystub view accessed through employee

self-service or by HR/Payroll.

Demand. The

Demand type process taxes using

daily tax calculations.

- Payroll

Period Indicator. The

selected "Payroll Period Indicator" option defines whether this

is the Current Payroll Period

or the first payroll of a New Month,

Quarter, or Year.

Setup for benefit hours-accrual and system invoicing can be defined to

use new month, quarter, or year periods when processing particular rate

policies for invoicing or for accruals.

- Payroll

of the Month. The

Payroll of Month field indicates

the payroll number for the month in which the payroll falls. Payroll processing

compares this entry to payroll of the month checkboxes on certain employee

details (along with effective dates) to determine whether a particular

detail should be included in this payroll run. The following details have

payroll of the month settings: Employee Auto Pays (to pay earnings on

a specific payroll each month), Deductions, and Tax Details.

- Payroll

of the Year number. The

number entered for the Payroll of Calendar

Year identifies the position of the payroll within a calendar year.

The check date or posted date often is a more significant indicator of

the sequence that payrolls were posted.

- Payroll

of the Fiscal Year number. The

number entered for the Payroll of Fiscal

Year identifies the position of the payroll within a fiscal year.

If the Fiscal Year is the same as the Calendar Year, January-December,

then both "year" numbers are normally identical.

- Force

Payments to check? During

a payroll run, an election can be made to make all payments checks and

ignore any ACH transactions for Net Pay. If you select the Force

Payments to Check indicator on the Payroll Calendar, the system

will ignore all of the ACH Net Pays

and all of the Default Pay Check Records, and all employee payments

generated by this Payroll Calendar will default into checks. The system

will look for the Default Pay Check Record to determine disbursement.

- Process

Benefits? The

Process Benefits indicator determines

whether benefits can be included in the processing for this payroll run.

For a specific Benefit to process during a payroll run, its Benefit

Effective Date set up on

each employee's Benefits Detail record must fall in the payroll period.

- Process

Hours Accruals? The

Process Hours Accruals indicator

determines whether hours-accrual processing can be included in the processing

for this payroll run.

- Create

History for EEs not Paid? Select

the Create History for EEs Not Paid

checkbox to create a pay history for employees without time records during

the pay period defined by this Payroll Calendar. This will only apply

to employees within the same pay group.

- Prior

Compensation? For

a payroll to be processed with the Prior Compensation Loader as part of

an implementation, select the Prior Compensation

checkbox. The Prior Compensation checkbox's value can only be adjusted

when a new Payroll Calendar is added. That checkbox is unavailable when

the record for a Payroll Calendar is edited.

When payroll steps are completed, the system

automatically selects the checkboxes for the following as the steps are

completed: Payroll Run Initiated (Gross to Net),

Created Auto Pay Records, Benefits Processed, and Payroll

Posted payroll indicators.

Buttons

- Payroll

Tasks. To

go to the Pay Run Task Manager for the payroll, click on the "Payroll

Tasks" button. When prompted, click OK to leave the Payroll Calendar.

- Payroll

Reports. To

go to the Payroll Reporting screen for a posted payroll, click on the

Payroll Reports button. When prompted, click OK

to leave the Payroll Calendar.

- Overrides.

To apply

global payroll overrides to an un-posted payroll, click on the

Overrides button on the Payroll Calendar. A "Global

Override" overrides each selected deduction, tax, and/or earning,

for every employee in the payroll run. From the Global Payroll Overrides,

to define an override for the payroll calendar,

select the checkbox next to each deduction, tax, or net pay to override,

and then Save.

- Posting Information.

To open

a summary of a posted payroll's information, click on the Posting

Information button.

Payment voids cannot be processed from the

online system.