Open topic with navigation

LTD Costing

Example

Long-term disability insurance may be costed

by cost rules.

For a long-term disability or group term life plan that is

categorized as Imputed Income

according to federal tax guidelines, verify that the set up of the Benefit

Code is defined as such and that the Earning Code for imputed income is

selected on the Benefit Code. Review the "Imputed Income" topic for setup requirements.

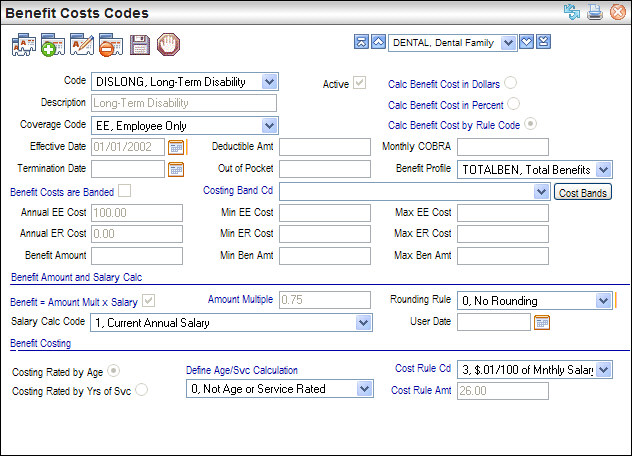

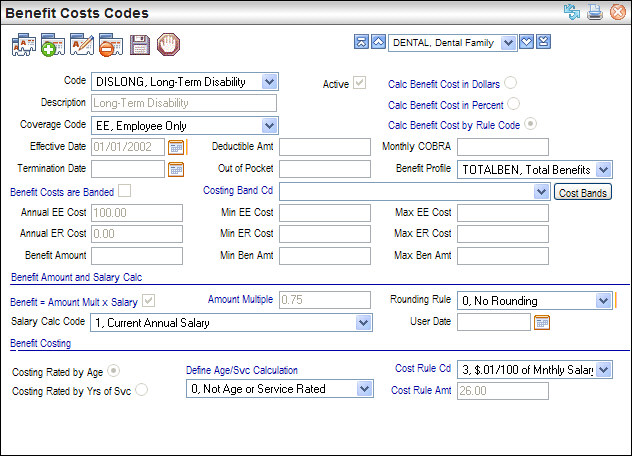

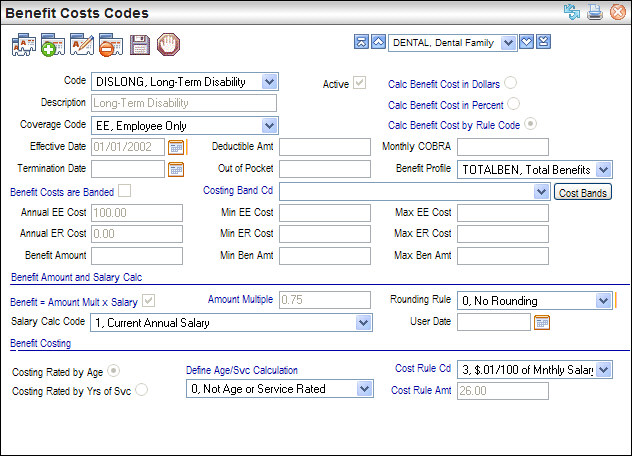

Benefit Costs Code for Long Term Disability Example

Example of LTD Costing

For this example, the annual cost of a long-term disability

plan costs $0.26 per every $100 dollars of an employee’s monthly earnings

and is neither age nor service rated. The plan is 100% employee-paid.

- Another way to

consider this equation is $0.26 x (Monthly Salary/100). So, the selected

Cost Rule Cd should be 3,

described as $.01/100 of Mnthly

Salary; and the Cost Rule Amount

should be 26.0000.

Here is how this is calculated.

First, determine the monthly salary

based on the annual salary on the employee’s Master record. For this example,

the annual salary is $113,505.60, so the monthly salary is $113,505.60

/ 12 months, which is a monthly salary of $9458.80.

26 x (Monthly Salary/100)

26 x ($9458.80/ 100)

26 x ($94.5880) = $2,459.288

If the employee is paid biweekly with 26 payrolls

per year, this will be calculated as $94.588, and will be rounded to $94.59

when deducted.

- Because the selected

cost rule code is by monthly salary, and not by monthly benefit amount,

the salary is not multiplied by 0.75 for this calculation. The benefit

amount is 0.75 times the employee’s

current annual salary. This is defined in the "Benefit Amount and

Salary Calc"

section. The salary calculation code is 1,

Current Annual Salary, the Amount Multiple is 0.7500,

and zero rounding will occur.

An employee with an annual salary of 113505.60

would have a calculated benefit amount of 85129.20.

Long-Term Disability Coverage Costing Example Instructions

The following instructions explain how to set up the Benefit

Cost Code for the benefit described in this example.

- Select the benefit

plan defined for this long-term disability benefit. As with all codes,

to be available in the system, a Benefit Cost Code must be Active.

Verify that the Benefit Costs Code is Active.

- Enter a Description,

such as Long-Term Disability, to

describe the benefit plan.

- Select the Coverage Code. Typically, coverage for

long-term disability coverage is employee-only, and has the EE,

Employee Only Coverage Code

selected.

- Verify that the

Effective Date is correct.

- For a plan calculated

by a cost rule code, the option for Calc

Benefit Cost by Rule Code should be selected.

- Define the percentage

of the cost to be paid by the employee in the Annual

EE Cost

field. When all of the costs associated with the long-term disability

plan are paid by the employee, 100% employee-paid, the Annual

EE Cost is entered as 100.0000.

- Define the percentage

of the cost to be paid by the employer in the Annual

ER Cost field. When the employer does not contribute to the plan,

the Annual ER Cost is entered

as 0.0000.

- To define costing

based on a cost rule, select the option for Calc

Benefit Cost by Rule Code, select the Cost

Rule Cd, enter the Cost Rule Amount,

and select the related Rounding Rule.

When no cost amount rounding applies, select 0,

No Rounding in the Rounding Rule

field.

- Define the value

of the benefit. When the amount available for the benefit is a multiple

times the employee’s salary, select the checkbox labeled Benefit

= Amount Mult

x Salary. The value in the Amount

Multiple field will be multiplied by the employee’s salary to define

the amount available for the benefit given an eligible long-term disability.

This means that the amount available for the benefit equals the Amount Multiple multiplied by the employee’s

salary.

For this example, and associated illustration,

the Amount Multiple is 0.75.

Since the selected Salary Calc

Code is 1, Current Annual Salary,

the benefit amount would be calculated as 0.75

times the current annual salary.

Benefit Amount = Amount Multiple x Annual Salary

- For a plan’s costs

that are not age or service rated, in the Age/Svc

Calculation field verify that 0, Not Age or Service Rated, is selected.

- Save.