Open topic with navigation

Employee Check View Detail

Overview

Overview

On Screen

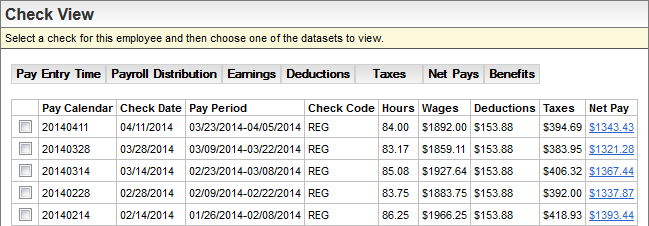

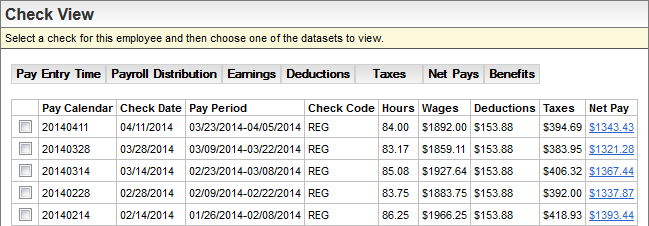

Instructions: Select

a check for this employee and then choose one of the datasets to view.

Check View Details

Check View Detail

On Screen

Instructions: Here

is a detailed view of this check. You can change the parameters using

the drop downs below.

Check View Details for the Taxes

Check View Detail Screen

To see the online payroll check summary, click on the link for a payment in the Net Pay column.

To see particular types of details, from the Check View screen,

select a payment, and click one of the buttons.

- Pay

Entry Time. To see the pay entry dataset for the payment, click

on the Pay Entry Time button.

The pay entry time dataset has

pay code (such as earning code), description, hours in dollars or a percentage,

and labor distributions (Labor1, Labor2, Labor3, Labor4), Taxing state,

and Rate for hourly rate.

- The check view

time record descriptions begin with a letters to indicate how the time

was entered and if it is non-paid. If the description begins with:

- "[A]"

then it was an auto-created record,

- "[I]"

then it was a time import, and

- "[M]"

then it was manual entry.

- An asterisk

* on a check-view earning description means non-paid (i.e. wages worked

not chosen).

- An asterisk

* on a check-view deduction description means an employer-paid deduction.

- Payroll

Distribution. To see the payroll labor distribution dataset for

the payment, click on the Payroll Distribution

button. The payroll distribution dataset

has labor distributions (Labor1, Labor2, Labor3, Labor4), and the distribution

percentage (Distrib %).

- Earnings.

To see the earnings dataset for the payment, click on the Earnings

button. The earnings dataset

has earning code, description, available hours, current hours or dollars

(a dollar sign indicates a dollar amount), per quarter subtotals (Q1 Total,

Q2 Total, Q3 Total, Q4 Total), and year-to-date total (YTD Total).

An asterisk * on a check-view earning description

means non-paid (i.e. wages worked not chosen).

- Deductions.

To see the deduction details for the payment, click on the Deductions

button. The deductions dataset

has deduction code, description (an * asterisk shows an Employer-paid

deduction), "Amount %" (dollar amount or percentage), current

deduction, per quarter subtotals (Q1 Total, Q2 Total, Q3 Total, Q4 Total),

and year-to-date total (YTD Total).

An asterisk * on a check-view deduction description

means an employer-paid deduction.

- Taxes.

To see the taxes withheld for the payment, click on the Taxes

button. The taxes dataset has

tax code, description (an * asterisk means an employer-paid tax), "Filing"

(filing status code), current tax, per quarter subtotals (Q1 Total, Q2

Total, Q3 Total, Q4 Total), and year-to-date total (YTD Total). Wages

for the tax are listed on a the next line with "(Wages)" at

the end of the description and yellow highlighting.

Tax amounts have blue highlighting.

- Net

Pays. To see the net pays for the payment, click on the Net

Pays button. The net pays dataset

has net pay code, description, form number, current amount, per quarter

subtotals (Q1 Total, Q2 Total, Q3 Total, Q4 Total), and a year-to-date

total.

- Link in the Net Pays Column: To open the paycheck stub view, click on the link in the Net Pay column. Result:

The online paycheck stub view displays for the selected net pay. To return

to the Check View Detail from the paycheck stub view, click on "Check View listing."

- Benefits.

To see the benefits for the payment, click on the Benefits

button. The benefits dataset

has a benefit code, description (coverage), "EE - Acr" (employee

cost or hours accrual), "ER -Avail" (employer cost or available

hours), and labor distributions (Labor1, Labor2, Labor3, Labor4), per

quarter accruals (Q1 Accr, Q2 Accr, Q3 Accr, Q4 Accr), and year-to-date

amount or accrual (YTD Accr).

To change the detail shown, choose a different dataset, pay

calendar, or check code.

To return to the main Check View screen, click on the "Back

to check listing" link.