Open topic with navigation

You are here: Reference > Wizards > Employee New Hire Wizard

New Hire Wizard

Overview

Overview

Panel 1, New Hire Wizard

Hire a New Employee

Complete all relevant information in the Employee

New Hire Wizard. Entries automate the creation of records and reduce

later data entry.

Panel

1

Panel 1, New Hire Wizard (Reduced Size)

- Open the New Hire Wizard. Follow the on-screen

instructions.

On-Screen Instructions:

Select

an existing applicant by Applicant Number, or select an onboarded employee.

Choose Non Applicant to enter all new information.

- Non-Applicants

lack an applicant record in the system. The

Non-Applicant

option is selected by default. For a non-applicant, leave the Non-Applicant option selected and click

Next.

- Applicants:

- For a candidate to be selected for new hire, the candidate needs to have a record in the Recruitment module and to have not been hired yet.

- For a corresponding requisition to be selected, the candidate's record needs to be set as hirable in the Recruitment module and the candidate needs to be associated with that Requisition.

- Onboard

EEs are individuals with an onboard record. On the rest of the

process screens, any information from and about the this individual that was finalized through the onboard processes is automatically available. (Assigning

self-service onboarding is a feature of Payroll & HR Enterprise.)

Note:

If you

don't complete required fields, and you click on Next,

then system will highlight the required fields until you complete the

required entries and continue.

Click on Next to

continue.

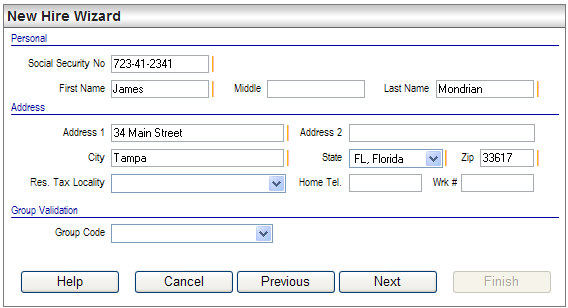

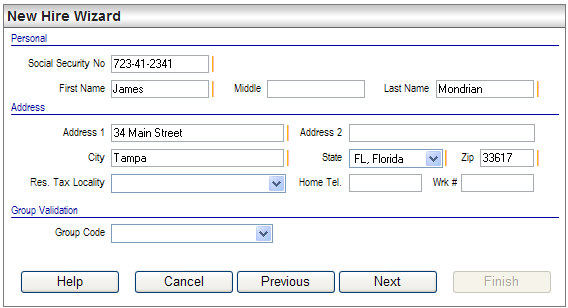

Panel 2

New Hire Wizard: Personal and Address

Address

- Social

Security No (required). Type

the new hire's Social Security number. See Social Security

Number validation rules for more information.

- First

Name, Middle name, and

Last Name.

Verify

or enter the new hire's First Name, Middle name, and Last Name. First

and Last Name are required.

- Card

Number (optional). A

card number for a time system can be entered for reporting purposes. If

your organization uses a SwipeClock®

integration, enter the Employee Number (defined on Panel 6) in the card

number field.

Verify (or enter) the new employee's primary home

address in the fields provided: Address 1, Address 2, City, State, and

Zip.

- Home

Tel. Enter

the home telephone number for the master record.

- Wrk

#. Enter

the new work telephone number for the master record and self-service phone

listing.

- Group

Code. Select

the Group Code for the validation group to which this employee will be

assigned (optional). Your system administrator sets up Group Codes to

allow employees to be grouped into codes to customize their available

validation code selections.

Click Next to continue.

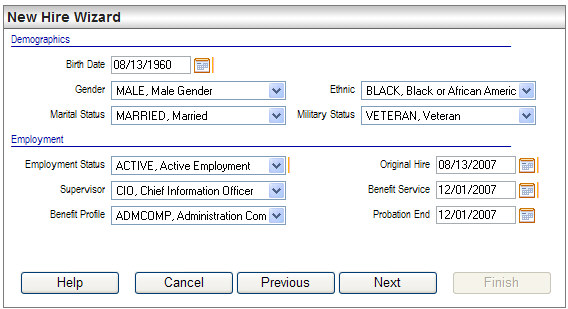

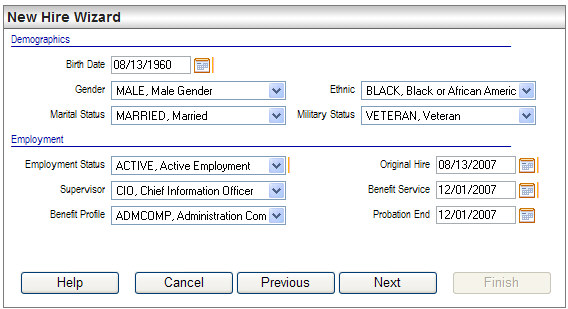

Panel 3

New Hire Wizard: Demographics and Employment

Demographics

- The Demographics

section migrate information to the Demographics tab within the Employee

Master. Demographic information can be automatically completed from the

applicant record, completed in the wizard screen, or completed later in

the Employee Master.

- Birth

Date, Gender, Marital

Status. Complete

the new hires Birth Date, Gender, Marital

Status where this information did not populate from the Applicant

module.

- Ethic.

Where available,

select Ethnic origin. This is

for EEO reporting.

- Military

Status. This

is for EEO reporting.

Employment

- Employment

Status. Select

the new hire's employment status.

- Supervisor. Select

the supervisor code.

- Benefit

Profile. Select

the Benefit Profile for the benefit

package that this employee will qualify for on the Benefit Service Date

(not required, but selecting a Benefit

Profile during the New Hire Wizard's process can automate the benefit

assignment process).

- Original

Hire Date. Verify

the Original Hire Date. The system

populates the new employee's Original Hire date with the current system

date. Edit this field as necessary to define the actual date that this

employee was first hired. Result: The

Original Hire date will be used to track an employees length of service.

- Benefit

Service. Enter

the benefit service start date according to your organization's benefit

policies. This date is used to begin any benefits for the benefit profile

that are defined to auto-create. The Benefit Service date may be the same

as the Original Hire date, or may be another date according to your organization's

policies.

- Probation

End. Enter

the Probation End date according

to your organization's policies. Many organizations use a standard 90-day

probation period based on the Original Hire Date.

Click Next to continue.

The next step is used to enter some of the payroll and compensation information.

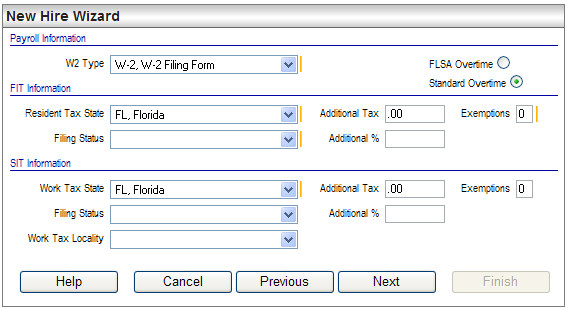

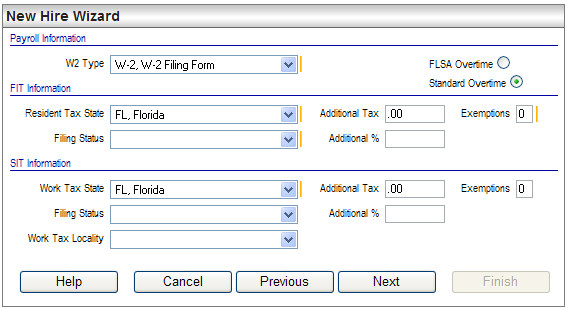

Panel 4

New

Hire Wizard: FIT and SIT

Payroll Information

- Complete the payroll

and tax information.

- W2

Type. In

the Payroll Information section, select the W2

Type filing form this employee receives at the end of the year.

Typically, this is W2, which is the default selection.

- FLSA

Overtime or Standard Overtime. Select

the type of overtime that applies to this employee: FLSA

Overtime or Standard Overtime.

FLSA overtime is for Fair Labor Standard Act (FLSA) overtime. To enable

FLSA overtime calculations, FLSA overtime should be selected on the employee's

master record. Result: The overtime selection

determines the selection on the employee's master record, where the option

can be edited.

FIT Information

For the FIT Information section, complete federal

income tax information.

- Resident

Tax State. Select

the Resident Tax State (the state

where this new hire resides). The Resident Tax State usually defines the

state government to which the employee is liable for withholding taxes.

- Filing

Status. Select

the new hire's declared federal tax Filing

Status.

- Additional

Tax. Enter

any additional tax amount, which will be added to the taxes withheld from

the tax tables during payroll processing. Result:

Additional Tax Withholding information for FIT flows to the Employee Tax

Detail for federal income tax.

- Additional

%. Enter

any additional tax percentage, which will be added to the taxes withheld

from the tax tables during payroll processing. Result:

Additional Tax Withholding information for FIT flows to the Employee Tax

Detail for federal income tax.

- Exemptions

(required). Enter

the number of tax Exemptions as

declared on the new hire's W-4.

SIT

Information

- Work Tax State. Complete

the state tax information. Select the new hire's Work

Tax State, which may differ from the Resident Tax State completed

in the previous section. The Work Tax State is the state in which this

employee actually works. This is used to determine the state unemployment

insurance record.

Note: If

the employee resides and works in the same state, the Resident Tax State

on the FIT Information and the Work Tax State on the SIT Information are

the same.

- Filing Status. Select

the new hire's declared state tax Filing

Status.

- Additional

Tax. Enter

any additional tax amount for state income tax, which will be added to

the taxes withheld. Result: Additional Tax

Withholding information entered here for SIT flows to the Payroll Detail

screen for Taxes.

- Additional %. Enter any additional

tax percentage for state income tax, which will be added to the taxes

withheld. Result: Additional Tax Withholding

information for SIT flows to the Employee Tax Detail for the selected

state.

- Exemptions.

Enter the number of state tax Exemptions as declared on the new

hire's State Withholding Certificate (or W-4 if the state doesn't require

a separate withholding certificate).

After the new hire, add any

additional Employee Tax Detail records needed. Confirm compliance with

state withholding laws. An employee residing in one state and working

in another may be liable for withholding taxes in both states and filing

a Non-Resident State Tax Return at year-end.

Local

Information

- Work Tax Locality.

Select the work tax locality

if a non-resident tax locality applies.

- Resident Tax Locality. Select

the resident tax locality if a resident tax locality applies. During new

hire processing, the resident tax locality selection directs creation

of a resident local tax detail for the employee and populates the resident

tax locality on the employee master.

- School District.

Select

the school locality to assign an employee to a school district tax locality.

Click Next to continue.

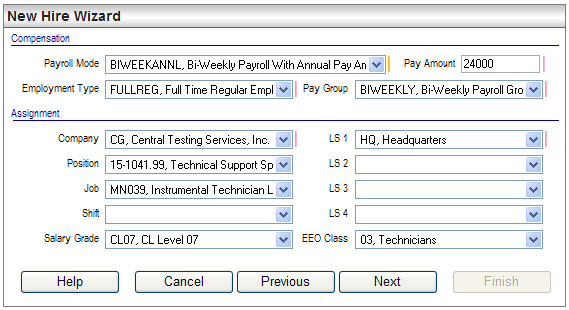

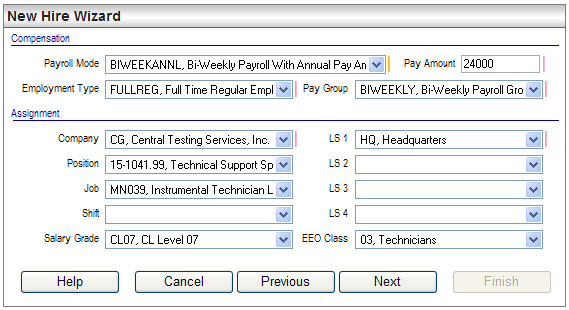

Panel 5

New Hire Wizard: Compensation

and Assignment Information

Compensation

- Compensation fields

are critical to payroll processing and should be completed with care.

Compensation fields calculate the Annual Pay, Pay Period Pay, and Hourly

Pay found in the Compensation tab within the Employee Master.

- Payroll

Mode. To define pay frequency and whether the pay amount

is hourly or annual, select the payroll mode.

- Pay

Amount. Define

the pay amount in dollars and cents.

- Employment

Type. To

identify the type of employment, including W-2 or 1099 status, select

the employment type.

- Pay

Group. To

determine which group of employees the employee is paid along with during

payroll, select the pay group assignment.

- Create

New Position? To

create a new position code from the information on this new hire, select

the "Create New Position" checkbox.

- Create

Auto Pay? To

create an Employee Auto Pay detail during new hire processing, select

the "Create Auto Pay" checkbox.

Assignment

The Assignment section will populate fields

found on the Assignment tab within the Employee Master record.

- Company.

Select

the Company. Result:The Company

selected here helps determine which tax codes are automatically assigned

to this employee at new hire.

- Job

Code. Select

the job code.

- Position

Code. Select

the position or define a new position code. Where the "Create New

Position" checkbox isn't selected, select an existing position code.

Where the "Create New Position" checkbox is selected, enter

the new Position Code.

- Shift

Code. Select

the primary shift code, if any.

- Salary

Grade. Select

the Salary Grade determined by

the new employee's annual salary and position. Result:

Where the Salary Grade is completed, then the Salary Grade generates

a value that indicates where this employee's salary falls within the company

range, which can be seen on the Compensation tab within the Employee Master.

- Workers

Comp. The

Workers Compensation classification can be identified by this Workers

Compensation Rate code selection.

- Job

Title. The Job Title is a free text field to define the new hire's

job title. This may auto-populate after the Position Code is selected

and can still be edited as needed.

- Labor

Seg 1 (required). Select

the labor segment 1.

- Labor Seg 2 through Labor Seg 4.

Select

additional labor segment levels as needed. Labor segments associate organizational

units with budget distribution, payroll accounting, and financial reporting.

- EEO

Class. Select

the EEO Class if the EEO class

doesn't populate or requires editing.

- Review

Freq. Select

the review frequency for performance reviews.

- Talent

Profile. To

assign a talent profile. This field is reserved for future functionality.

- Performance

Profile. To

assign a performance profile. This field is reserved for future functionality.

Click Next to continue.

If position control is activated, clicking

Next checks the budget for the position. If this new hire will cause the

budgeted dollars or FTE allocation to be exceeded, a warning prompt displays.

Click OK. If you would like to make a change, return to the previous step

to change the new hire's assigned position or cancel the new hire.

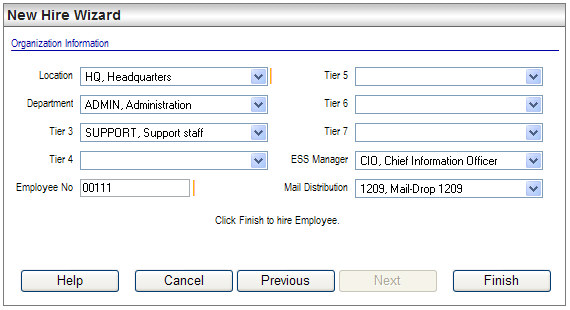

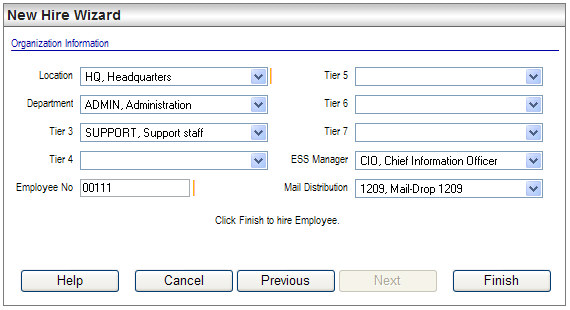

Panel 6

New Hire Wizard, Panel 6

Organization Information

- Fields on this

screen populate fields on the Assignment tab within the Employee Master.

Select the appropriate organization tiers for the new hire's position

in the organization. Each employee must be assigned to organizational

(tier) levels within the organization for HR purposes.

- Location

(required).

Select

the location code. A location assignment may determine what accounts are

used to pay an employee.

- Department. Select

the department code.

- Tier

3 through 4.

Select

tiers 3 through 4 as needed.

- Employee

No. Optionally,

edit the Employee No (Employee

Number) as needed. The new hire wizard automatically populates the Employee

Number field with the next available number. You may enter another unique

number can be assigned as the new hire's Employee Number. Result: The Employee Number cannot be edited later.

- Tier

5 through 7.

Select

tiers 5 through 7 as needed.

- ESS

Manager. Assign

an Employee Self Service Manager to the employee.

Result: The assigned

supervisor who is the employee's ESS Manager will have authorization to

view and update records for the employee if Manager Self Service is used.

- Supervisor.

Assign

the supervisor or manager that the new hire directly reports to.

- Mail

Distribution Code. The

mail distribution determines check sorting.

- Mail

Distribution Code. The

mail distribution determines check sorting.

- Click Finish

to hire the new hire into the system. Result:

A system prompt displays to verify that you wish to hire this employee.

- Click OK.

Results: If

you click on the OK button in

response to the prompt, the system will process the new hire. The new

hire may take a few moments to process.

When the employee is successfully added to the

system, a confirmation message box displays. The wizard migrates the entered

information into a new Employee Master record with an Employee Number

and an Employee Identifier of

1.

- Click OK.

New Hire Prompt

New Hire Message

New Hire Prompt

New Hire Confirmation and Access to Payroll Details at

the End of the New Hire Process

New Hire Confirmation and Details

- Click on a button

to open the detail screen. Add and edit relevant detail records as needed.

Have a payroll-knowledgeable person complete or review the Payroll New

Hire Details for each new hire. To close the detail's secondary window,

click on the cancel button in

its right corner.

- Click Finish.

Results: The

wizard will ask if you would like to hire another employee.

You may opt to click OK

to return to the first Panel of the New Hire Wizard. Otherwise, click

Cancel. Later, navigate to the

Employee Master, verify and enter further information as needed.

The results of the Employee New Hire wizard are described

in the Overview topic for New Hires.