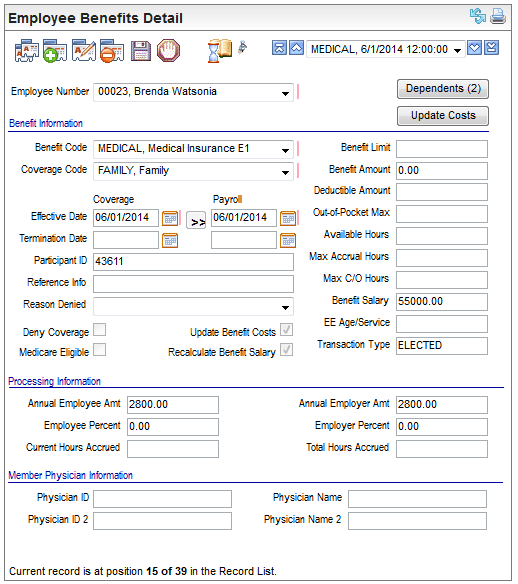

- Employee Number. The employee whose benefit is being defined is in the Employee

Number field.

- Beneficiaries/Dependents

button. . For a plan and coverage that can have beneficiaries or dependents, a button for either a beneficiaries or dependents displays.

Benefit Information

- Benefit

Code. To assign a new benefit, select the benefit. Many fields populate with default information based on the

selected Benefit code. Adjust the pre-populated information as needed.

When updating an existing benefit, consider whether to end-date the current record and define a new Employee Benefits Detail for a change in coverage, etc.

If the data required data didn't populate, enter it

now. Follow your organization's policies.

- Coverage: Effective Date. The

coverage effective date is used to track the start date for coverage.

The current date is populated as the effective date when you add a record

on the Employee Benefit Detail screen; however, this date should be modified

as needed.

To set employee records to define coverage effective

on a future date, enter the coverage begin date in the Effective Date

field in the "Coverage Dates" column.

- Coverage: Termination Date. The

coverage Termination Date is when the plan is no longer in effect. Often

the coverage termination date is on or after the payroll Termination Date.

When a coverage is scheduled to end in the future, that future end date

can be entered as the coverage Termination Date.

- Payroll:

Effective Date. The

payroll effective date is used to determine when to begin processing a

benefit's payroll deductions or earnings. The current date is populated

as the effective date when you add a record on the Employee Benefit Detail

screen; however, this date should be modified as needed.

To set employee records to access the new plan

when the effective date arrives, enter a future effective date that is

within the pay period that the benefit and benefit deductions should begin.

- >>

button. To

update the payroll effective date based on the coverage effective date

and the applicable Benefit Eligibility Rule record, click on the >> button next to the payroll

Effective Date field. This button is availalbe

when the record is in edit mode.

- Payroll: Termination Date. A

benefit and its associated deductions remain effective for pay periods

before the benefit termination date. A future termination date can be

entered.

A termination date before the pay period's

end date stops the benefit coverage and its deductions.

A termination date after the pay period's

end date indicates an active benefit that can be processed as part of

the payroll.

Ending Benefit Coverage by

an Existing Plan. To end an Employee Benefit Detail for an employee, first determine when the

benefit's costs should no longer be deducted. Look at the pay period schedule

that affects this employee's pay. Choose a Termination Date that equals

the last date in the pay period for this benefit coverage's final processing

for this employee.

- Participant ID. The Participant ID is an optional informational field used to identify this employee for reporting purposes.

- Reference

Info. Reference Info is an optional informational field used to record reference information

for this Benefit Plan for reporting purposes.

- Reason Denied.

The Reason Denied value is any reason that the employee declined coverage.

This is typically gathered through Employee Self Service enrollments where a plan is defined to require employee-level ACA tracking.

Select each of the next checkboxes as appropriate:

Declined Coverage, Medicare Eligible, Update Ben. Costs, and/or Recalculate

Benefit Salary.

- Declined

Coverage? If this employee is denied coverage under this Benefit Plan, select the Deny

Coverage checkbox.

- Medicare Eligible? If

this Benefit Plan is Medicare Eligible, select the Medicare

Eligible checkbox.

- Update

Benefit Costs>? To allow Benefit Costs to update based on the costs defined for the plan

and coverage on the code-level and to allow processing to update any EE Age, select the "Update

Ben. Costs" checkbox. To override the costing and stop calculated Age/EE Service years

now and in the future for this Employee Benefits Detail, clear the "Update Ben. Costs" checkbox.

- Recalculate

Benefit Salary? To allow the benefit salary for benefit calculation purposes to recalculate

when the employee's pay on the master record changes, select Recalculate

Benefit Salary.

Limits and Amounts

The Benefit Cost Code for this Benefit Code and Coverage

Code are used during payroll processing to populate dollars where appropriate

related to Benefit Limit, Benefit Amount, Deductible Amount, and Out-of-Pocket

Max.

- Benefit Limit. To

impose a limit on this employee’s benefit amount due to limits set by

regulatory guidelines, benefit plan rules, or your company policies, enter

the limit amount in the Benefit Limit

field.

- Benefit

Amount. In

the Benefit Amount field, enter the amount of coverage applicable to this benefit, if any. (If this entry

was not defined on the Benefit Costs Code associated with the Benefit

Code).

- Deductible

Amount. If this benefit has a deductible, enter the amount in the Deductible

Amount field. (If this entry was not defined on the Benefit Costs

Code associated with the Benefit Code).

- Out-of-Pocket

Max. The

optional Out-of-Pocket Max entry

is helpful information for employees and personnel but is not needed to

define benefit costs. For benefit plans that limit the personal expense

to the employee, enter the amount of employee personal expense in the

Out-of-Pocket Max field, if this entry was not defined on the Benefit Costs Code associated with the Benefit

Code.

- Available

Hours. For benefit-hours, when accrual hours are associated with the selected Benefit

Code, this field updates automatically when payroll posts. When initially

setting up your system, if available hours should to carry over from a

previous system, record them in the Available

Hours field.

- Max Accrual Hours. For benefit-hours,

when accrual hours are associated with the selected Benefit Code, this

field updates automatically when payroll posts.

- Maximum

C/O (Carry Over) Hours. Maximum

carry over hours populate from the benefit hours accrual policy for this

benefit, if any. For benefit-hours, when accrual hours are associated

with the selected Benefit Code, this field updates automatically when

payroll posts.

Note: If the

system is defined to pay employee PTO accrual benefit hours in arrears,

the system will pay PTO benefit hours entered for the pay run and adjust

the employee's Available Hours with a negative balance here on the Employee

Benefits Detail and also on the Employee Earnings Detail screen.

- Transaction

Type. The

transaction type displays as a read-only value. For a benefit that was

added through a self-service enrollment, the transaction type is ELECTED.

Processing Information

- Annual Employee Amt and Annual Employer

Amt. Annual amounts and percentages apply to benefit costs.

The Benefit

Cost code associated with the Benefit code and Coverage code provides

the Annual Employee Amt and Annual Employer Amt values for payroll

processing. Entering amounts on the Employee Benefits Detail will override

these system-wide amounts (whether from Annual Costs entered or Benefit

Cost Bands).

- Annual

Employee Amt. The

employee cost field shows an annual dollar amount.

- Employee

Percent and Employer Percent. The

Employee Percent and Employer

Percent can be overridden per employee on the Employee Benefits

Detail.

- Total

Hours Accrued. The Total Hours Accrued field should

reflect the hours accrued thus far. Often, a new hire does not have accrued

hours for benefit plans such as PTO right away. When initially setting

up your system, if the total accrued hours are available, complete the

Total Hours Accrued field.

Member Physician Information

- Physician ID. If the employee designated a primary care provider, such as for some HMO plans, then the primary care provider number can be entered as the Physician ID.

- Physician Name. If the employee designated a primary care provider, such as for some HMO plans, the physician's name can be entered as the Physician name.

- Physician ID 2. If the employee designated a secondary care provider, such as for some HMO plans, then the identifier for the secondary care provider can be entered as Physician ID 2.

- Physician Name 2. If the employee designated a secondary care provider, such as for some HMO plans, then the name of the secondary care provider can be entered here.