Open topic with navigation

Tax Locality Codes

The Tax Locality Codes

Table provides codes that complete the Tax Codes for local taxes

on the Tax Codes Table.

A Tax Locality refers to an area that has Local Taxes. Any

area defined by the government below the state level, that taxes its residents

or workers, is a tax locality.

Typically, access to the validation table for tax locality setup is unavailable through the web portals.

Business Scenario

When any of a company's

employees live or work within a tax locality, the tax locality becomes

significant for payroll processing purposes.

Typically, an organization would activate each local taxing authority

that applies to their employee’s tax localities. Each Tax Locality Code defines the local tax authority

and State.

Additional tax localities and tax codes may need to be added. For Alaska reporting, additional tax locality codes need to be added for

geographic codes. See "Alaska's Occupational

Codes."

Additionally, other tax localities have specific setup requirements.

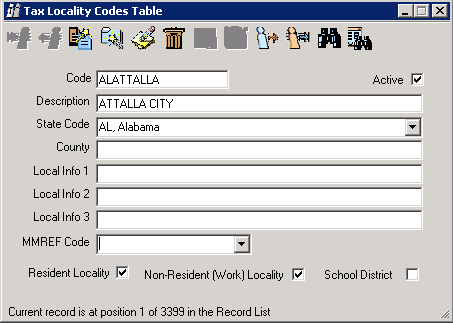

Fields on the Tax Locality Codes Table

Fields on the Tax Locality Codes Table

- Code. Enter a Code, of ten characters or less

with no spaces or special characters.

- Description.

Enter a Description of thirty characters or less.

- Active?

An active code has the Active checkbox selected, making the code available and keeping the code in effect as a valid choice.

- State. Choose the state where this locality is located.

- County. Enter the county, if applicable.

- Local Info 1. For some local reporting, such as for PA Act 32, the appropriate Political Subdivision Code (PSD code) needs to be in the Local Info 1 field for an applicable tax locality.

- Local Info 2. For some local reporting, such as for PA Act 32, the appropriate Municipal code needs to be in the Local Info 2 field for an applicable tax locality.

- Local Info 3. The Local Info 3 value may be required for some tax locality information,

- MMREF Code.

If a year end reporting file needs to be created for the locality, select the relevant MMREF code. The system has many pre-defined MMREF codes for local year-end reporting.

- The following checkboxes are used to define the locality type:

- Resident Locality. For a locality for local resident taxes, select the checkbox for Resident Locality.

- Non-Resident (Work) Locality. For a locality for work taxes, select the checkbox for Non-Resident (Work) Locality.

- School District. For a locality for school district taxes, select the checkbox for School District.