Open topic with navigation

Benefit Cost Codes Table

Overview

Overview

Benefit Cost Codes Table

Add a Benefit Costs Code

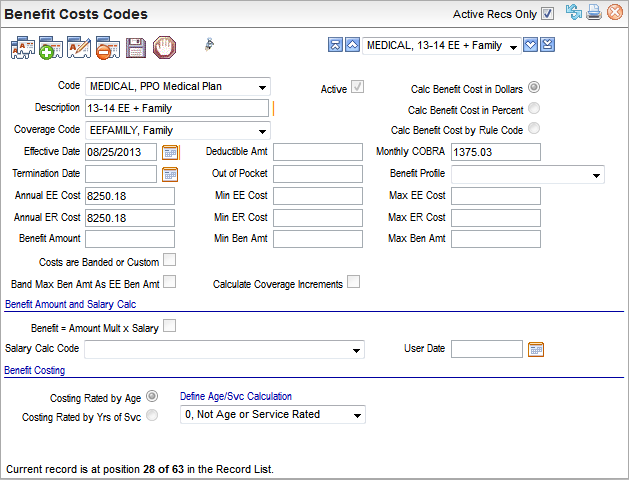

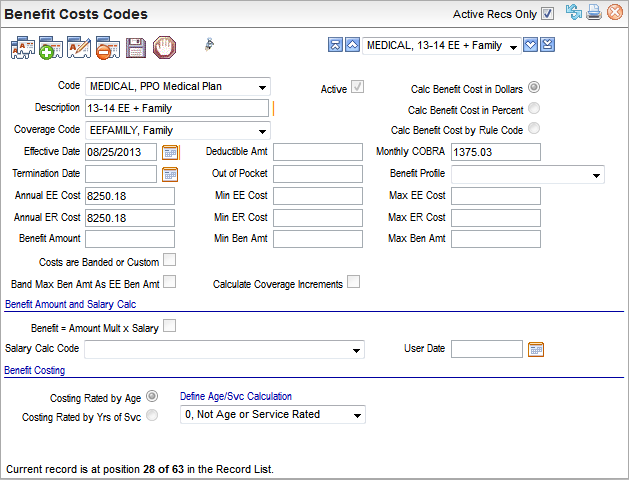

The Benefit Costs screen can be launched from the Benefit Codes Table.

- For the online

version of this screen, the fields that display are conditional based

on what is selected on the current record.

- For the Enterprise

Client version of this screen, the Cost Bands button is not available.

Instead, Cost Band records need to be defined through the online product.

For more information, refer to: Benefit

Cost Code - Adding.

Benefit Cost Record

Benefit costs are unique by Benefit code, effective dates

(effective and termination dates), coverage code, and benefit profile.

- Active? A

selected Active

checkbox puts the code into service. To remove a cost record from service,

it should have a termination date based on payroll periods. In some cases,

a terminated benefit cost also has its Active

checkbox cleared to take the cost record out of service.

- Code. The

Benefit code for this benefit cost.

- Description. The

text Description to identify the

benefit cost. This can be up to thirty characters with spaces. Often,

the plan year is entered as part of the description.

- Coverage. Select

the Coverage Code to associate coverage with costs.

Coverages may be filtered based on the benefit type for the benefit code

itself. If necessary when editing, re-select the benefit code with a mouse-click,

then select the coverage code.

Effective Dates

- Effective. The

effective date identifies the begin date for the benefit costing. When

reviewing this date, consider the pay period effective dates.

- Termination (optional).

The termination

date identifies when this coverage and costing expires. When reviewing

this date, consider the pay period effective dates.

Look to the upper right section of the screen, under the

cost options and under the Monthly COBRA field.

What Type of Annual Costs? Banded? Increments for Benefit

Amounts?

- CalcBenefit Cost... This

set of three option buttons determines the general method for the cost

calculations.

Cost Type Options

|

Option

|

Functionality

|

Common Use

|

|

Calc Benefit Cost in Dollars

|

Cost is calculated (A) based on dollar amounts entered

in the Annual EE Cost and Annual ER Cost fields or (B) is based

on dollar amounts entered for cost bands.

|

Often, medical plan and dental plan costing is in dollars.

|

|

Calc Benefit Cost in Percent

|

Costing is calculated based on percentages. The following

fields are interpreted as percentages when this option is selected: Annual EE Cost, Annual ER Cost, Min EE Cost,

Min ER Cost, Max

EE Cost, and Max ER Cost

fields.

|

Some deferred compensation plans have a coverage that

needs to be costed as a percentage.

|

|

Calc Benefit Cost by Rule Code

|

Costing is calculated according to cost rule for salary

or benefit amount. Costs will be allocated according to percentages entered

in the Annual EE Cost and Annual ER Cost fields. Cost

banding can be activated and applied.

|

Often, life insurance costing is by rule code.

|

Look midway down the screen, and see if benefit costs are

banded or custom.

- Benefit Costs are Banded or Custom? (optional).

If this benefit is cost-banded or has costs defined through custom-programming,

this checkbox and the Band/Custom

Cd should be selected. Access the setup for benefit cost band codes

through the web product using a web role, such as Payroll & HR Enterprise.

- Band Max Ben Amt As EE Ben Amt? (optional). To make the maximum benefit amount for the applicable cost band be applied to an employee as the employee's Benefit Amount and Benefit Amount Limit for the plan and coverage, select "Band Max Ben Amt As EE Ben Amt", select the checkbox for “Costs are Banded or Custom”, and select the applicable band code.

- Calculate

Coverage Increments? (optional). For

a plan with cost bands, coverage benefit amounts can be defined in increments, by selecting

the checkbox for "Calculate Coverage in Increments" and defining the amount between increments.

These types of plans often

offer coverage every 1000, 5000, or 10000 dollars between the minimum

and maximum benefit amounts. This method requires using a cost band and cannot be used with the "Band Max Ben Amt As EE Ben Amt" feature.

- Increments

(optional). Where

the checkbox for "Calculate Coverage Increments" is selected,

enter the amount that each coverage level increases as the increments

value. These types of plans often offer coverage every 1000, 5000, or

10000 dollars between the minimum and maximum benefit amounts.

On the online screen, the "Calculate Coverage

Increments" checkbox needs to be selected for the corresponding Increments field to display.

Deductible, Out of Pocket, and Monthly COBRA

- Deductible (optional). If

the plan has a set deductible amount, that can be entered in the Deductible Amt

field.

- Out

of Pocket (optional). If

the plan has an out of pocket maximum, that can be entered as an Out of Pocket maximum for the benefit

on this screen.

- Monthly COBRA. The

monthly COBRA premium for this benefit can be entered in the Monthly COBRA

field. This is also left blank where the benefit code is not COBRA-eligible

or where the COBRA cost is calculated by a formula and is manually entered

on the Employee COBRA Detail.

Benefit Profile

- Benefit Profile (optional).

If this

benefit cost only applies to a specific benefit profile, select that benefit

profile. Otherwise, leave the benefit profile selection blank. As part

of a benefit setup, the benefit code itself should also be selected in

the benefit profile's New Hire Profile Setup (available

through the Enterprise Client program).

Costs in Percentages or Dollars?

When "Calc Benefit Cost by Rule Code" is chosen,

enter the percentage in Annual EE Cost (the percentage of total cost paid

by the employee to receive the benefit) and the percentage of the Annual

Employer Cost. For instance, 50% would be entered as 50. Avoid

under or over allocating for a benefit calculated as a percent: the Annual EE Cost plus the Annual

ER Annual Cost should have a sum equal to 100 when these values

are percentages.

- Annual

EE Cost. The

annual employee cost in dollars and cents or as a percentage. When no

value is entered and for plans with types other than for deferred compensation,

FSA, or similar contribution plans, the system interprets a blank (empty)

value as being 100.00. For no cost or contribution, enter a 0.00.

- Annual

ER Cost. The

annual employer cost in dollars and cents or as a percentage. For a percentage,

this would be the percentage of total cost paid by the employer to provide

the benefit to the employee. When no value is entered and for plans with

types other than for deferred compensation, FSA, or similar contribution

plans, the system interprets a blank (empty) value as being 100.00. For

no cost or contribution, enter a 0.00.

When the values for EE Amount and the ER Amount are considered

percentages versus when are these dollars depends on the selected costing

option. Review these selections before defining the costs. For dollars,

the option is "Calc Benefit Cost in Dollars." For percentages,

the option is "Calc Benefit Cost by Rule Code."

Minimum Costs?

- Min EE Cost. If

a minimum applies, enter the employee's minimum cost or percentage in

Min EE Cost. Also, if that cost

is predetermined, entering that cost or 0.00 as the minimum often is recommended.

- Min ER Cost. If

a minimum applies, enter the employer's minimum cost or percentage in

Min ER Cost. Also, if that cost

is predetermined, entering 0.00 or that cost often is recommended.

Maximum Costs?

- Max EE Cost. If

a maximum cost applies, enter the employee's maximum cost or percentage

in Max EE Cost. Also, if the cost

is predetermined, entering that cost as the maximum often is recommended.

- Max ER Cost. If

a maximum cost applies, enter the employer's maximum cost or percentage

in Max ER Cost. Also, if the cost

is predetermined, entering that cost as the maximum often is recommended.

Annual Benefit Amounts

A benefit amount is not a cost. The benefit amount can be

considered how much an insurance might pay under particular situations.

For instance a 50,000 in life insurance coverage would be expected to

have a benefit amount of 50000 in the system.

Methods to Define an Annual Benefit Amount (Step

13)

|

Setup

|

Functionality

|

Common Use

|

|

Benefit Amount

Enter the plan coverage's benefit amount in the Benefit

Amount field if it is a preset value.

|

This defines a preset Benefit Amount for the benefit

plan and coverage code.

|

If this benefit coverage pays a standard amount per

occurrence, enter that amount here.

For instance, if a company offered $15,000 of group

life insurance coverage, 15000 would be entered in the Benefit Amount

field for that benefit coverage.

|

|

Benefit Amount by Salary Calculation

Select the "Benefit = Mult x Salary" checkbox.

Enter the Amount Multiple.

Select the Salary Calc Code.

Select the Rounding Rule.

|

To calculate benefit amounts based on salary multiplied

by an amount multiplier and a cost rule amount.

|

Some AD & D plans are calculated based on salary

divided by a cost rule and multiplied

by a rate factor.

|

- Benefit Amount (optional). A

benefit amount is not a cost. The benefit amount can be considered how

much an insurance might pay under particular situations. For instance

a 50,000 in life insurance coverage would be expected to have a benefit

amount of 50000 in the system. If

this benefit coverage pays a standard amount per occurrence, enter that

amount here. For instance, if a company offered $15,000 of group life

insurance coverage, 15000 would be entered in the Benefit

Amount field for that benefit coverage. Also refer to the section

of the screen labeled, "Benefit Amount and Salary Calc."

- Benefit Amount by Salary Calculation

(optional). Optionally,

define the calculation for the value of the benefit amountbased

on the rules in the "Benefit Amount and Salary Calc" section.

- Benefit

= Mult x Salary indicator. To

calculate benefit amounts based on salary multiplied by an amount multiplier

and a cost rule amount, the Benefit =

Mult x Salary checkbox is selected.

- Amount

Multiple. Enter the Amount Multiple.

Benefit Amount= Amount Multiplier

x EmployeeSalary x Cost Rule Amount

- Salary

Calc code. The

Salary Calc Code determines whether salary calculations

for benefit amounts is not calculated, is the current annual salary, is

based on the benefit cost's user date, or is the salary on the coverage

effective date. When

2, Salary As Of Costing User Date,

is the selected salary calculation code, also complete the User

Date field.

- Rounding

rule. The Rounding Rule applies a rounding

convention to the Benefit Amount calculation,

whether it isn't rounded, is the nearest 1000, next highest 1000, or is

truncated to be the lower 1000.

Minimums and Maximums

- Min Ben Amt. This

is the minimum benefit amount to apply a minimum. This may also be 0.00

or the standard benefit amount if no minimum applies.

- Max Ben Amt. This

is the maximum benefit amount to apply a maximum limit. This may also

be the standard benefit amount if the standard benefit amount is also

the maximum. Consider plan rules or regulatory guidelines require an annual

limit on the benefit amount.

Benefit Costing Section: Plan Costed by Cost Bands for

Years of Service or Age?

- Rate Costs by Age or Years of Service (optional). When costs are rated by years, this

indicates that cost bands are needed.

Benefit Cost = Cost bands rated by age or years of service

If

the costs are not rated by age or years of service, you can opt to leave

"Rated by Age" selected and choose 0,

Not Age or Service Rated, in the next field for Age/Svc

Calculation.

- Rated by Age? The option for Rated by

Age option often is selected

when a plan's costs differ based on an employee or spouse's age. This

is also the default selection for whether a plan is costed by age or by

years of service. When the corresponding age or service calculation is

0, then age is not a factor in the costs.

- Rated

by Yrs of Svc? For

costs rated by the employee's number of years of service, click on the

Rated by Yrs of Svc option.

- Age/Svc

Calculation. The

way that years are calculated is defined in the Age/Svc

Calculation field. (Refer to information about Benefit

Age/Svc Calc Rules.) If not rated by age or years of service, select

0, Not Age or Service Rated in

the Age/Svc Calculation field

on the Benefit Cost Code.

- Costs

are Banded or Custom. A

selected checkbox for "Costs are

Banded or Custom" indicates that cost banding or a custom

program applies. Cost bands are often for plans rated by age or years

of service apply.Use

a web role, such as Payroll & HR Enterprise to confirm the cost

bands.

- Band Max Amt As EE Benefit Amt. When the checkboxes for "Band Max Ben Amt As EE Ben Amt" and "Costs are Banded or Custom" are selected along with a cost band, then the maximum benefit amount for the applicable cost band become the Benefit Amount and Benefit Amount Limit for the employee on the Employee Benefit Detail for the benefit plan and coverage. Most often, this is used for life insurance plans that decrease the benefit amount based on years.

Benefit Costing Section: Plan Costed by Cost Rules?

- Cost Rule Cd. For

benefits calculated by cost rules, select the Cost

Rule Cd.

The Cost Rule Codes

chart indicates what codes calculate which fraction of the salary.Benefit plan costs calculated by Cost Rule Code are calculated

as a fraction of the salary (or of the benefit amount) multiplied by the

Cost Rule Amount. Confirm that the option for "Calc Benefit Cost

by Rule Code" is selected in the upper right portion of the screen.

Benefit Cost = Fraction

of Cost Rule x Salary or Benefit Amount x Cost Rule Amount

- Cost Rule Amt. A

cost rule amount is the exact amount to apply to the selected cost

rule in the Cost Rule Amount

field. The number can be defined into the thousandths, such as 1.123,

or more rarely is a whole number.

When a cost rule amount is used in benefit calculations,

it is a multiplier.

For instance, a cost rule amount of 2

with cost rule 4, $0.01/10 of Weekly

Salary, would equal $0.02/10 of weekly salary, which is the weekly

salary multiplied by 0.002. In this instance, if the weekly salary was

$500.00, then the benefit cost would be $1.00. The benefit cost would

then be distributed according to the percentages in the Annual

EE Cost and Annual ER Cost

fields.

When the benefit cost setup applies a cost rule,

yet no cost rule amount is available, then the system will try to interpret

a blank (empty) cost rule amount field as a 1.00, but it is clearer to

enter 1.00 in that case.