Open topic with navigation

Benefit Cost Bands

TABLE NAME: VAL_BENCOSTALTBANDCODES

Details

Details

Benefit Cost Bands define advanced rate definitions for

benefit costs based on years of age or service, minimum and maximum benefit

amounts, gender, tobacco use status, and/or zip code. Some or all of these

criteria may apply to a particular plan. These records are called cost

bands because the rows in rate tables from insurers look like horizontal

bands.

If a benefit's costs do not vary based on years, gender,

tobacco use, or zip code, then cost bands may be unnecessary. However,

having any of those variations indicates that cost bands may be needed.

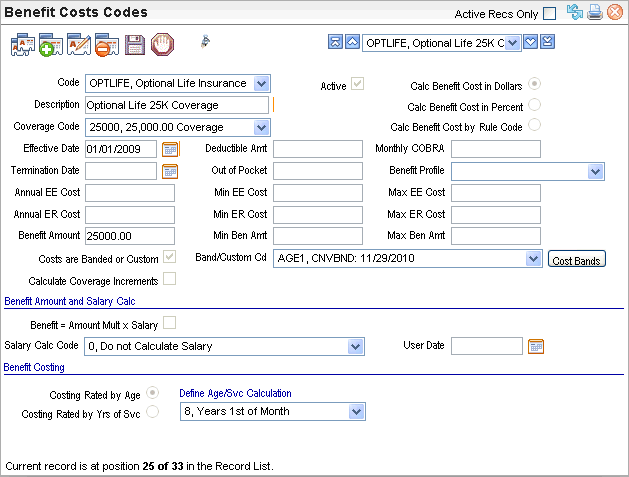

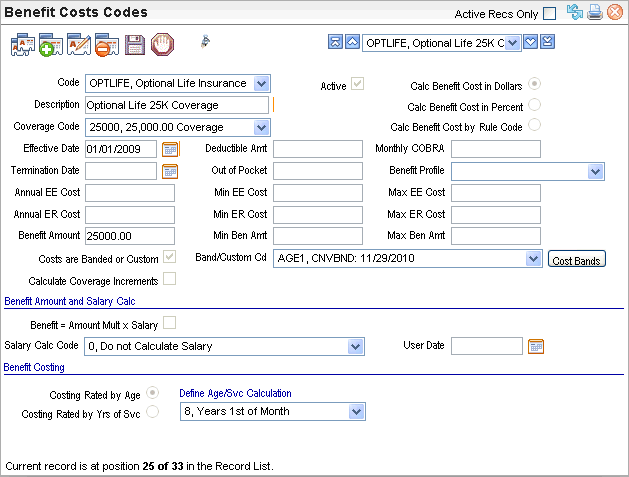

On a Benefit Cost Code, a checkbox indicates that the plan's

costs are banded or custom. That checkbox for "Costs are Banded or

Custom" controls the display of the field for "Band/Custom Cd"

and whether the Cost Bands button displays on the online Benefit Cost

Codes table. To see the "Band/Custom Cd" field and the Cost

Bands button online, login online through a web role such as Payroll &

HR Enterprise. Open the Benefit Code, and then the Benefit Cost Code.

On the

Benefit cost code, to display the button for Cost Bands, select the checkbox

for "Band/Custom Cd". The

Cost Band button and access to benefit Cost Band Code records is only

available online. Setup or verification of Cost Band setup is unavailable

through Enterprise Client or Mangrove PODS Administrator.

Several setup tables and employee-level records facilitate

cost banding. To include cost bands in cost calculations, on the Benefit

Cost record, the checkbox for "Costs are Banded or Custom" needs

to be selected and the Cost Band code for the intended Cost Band record(s)

needs to be selected. For gender codes, the setup of gender codes is standardized.

Tobacco use codes are standardized to a set of 3 numeric options. Cost

bands based on age or years of service rely on the corresponding setup

on employee records. Employee age is based on the birthday on the Demographics

tab and how the age calculation is defined on the Benefit

Cost record. Spouse age relies on the setup of an Employee

Contact Detail with the spouse's birthday and a relationship code

that is set to be for a spouse and on the existence of an online Employee

Beneficiary/Dependents Detail for the spouse and the plan.

Benefit Cost Bands Table

Define Cost Bands

Setup or verification of Cost Band records is online only. The screen

to define valid cost bands is unavailable through Enterprise Client or

Mangrove PODS Administrator.

- Log into a web

role with access to benefit setup tables, such as Payroll & HR Enterprise.

- From the Validation

Tables, open the Benefit Codes Table,

and click on the button for "Benefit Cost Codes."

- On the Benefit

Cost Codes table, navigate to the record that you want to view cost bands

for. For a plan with bands:

- Verify that

either the option is selected to Calc

Benefit Cost in Dollars or to Calc

Benefit Cost by Rule Code.

- Verify that

the checkbox for "Costs are Banded or Custom" is selected. This

checkbox needs to be selected to display the "Band/Custom Cd"

field and Cost Bands button (online only).

- In the Band/Custom Cd field, select the cost band if the band

already exists.

- To open the Cost

Band Codes Table, click on the Cost Bands

button. If this button is not available, select the checkbox for "Costs

are Banded or Custom" first.

- Code

(required). Enter

a code of ten characters or less with no spaces or special characters.

For Cost

Band Codes, if there are different tables needed based on gender, tobacco

use status, or zip code, define multiple records with

the same Code value. This differs from the setup of many tables,

which normally require a unique value by code. One Cost Band Code can

be selected per Benefit Cost Code record, but all Cost Band records with

the same Code value can be used by benefit processing for that record.

This enables more options for the setup.

- Description

(required). Enter

a description of thirty characters or less for the cost band. When more

than one Cost Band record exists with the same code, consider adding Multi

to the description. Some

cost bands have a description with the letters CNVB and a date in the

description, which often indicates that a cost band record was first defined

before the structure of cost bands was updated in 2010. Those descriptions

can be modified to better summarize the purpose of the record.

- Active? An

active code has the Active checkbox selected, making the code available

and keeping the code in effect as a valid choice. Where more than one

Cost Band record has the same code, the Cost Band Code may remain selectable

if code records with the same name remain active.

Cost Filters

- Define Cost Filters as needed.

Each cost band can be filtered to apply to only employees with the following

demographic factors. By defining multiple Cost Band Codes, different cost

tables can be defined to apply to these criteria. If you complete any

cost filters, the setup may need additional Cost Band records. For instance,

if a set of costs applies to males, a set of costs would typically be

needed for females, and there may need to be another set of costs for

any other gender designation found in the system.

- Tobacco

Use. To

define a cost band by tobacco use, select a tobacco

use code in the Tobacco field.

When this isn't relevant, select code 3, Tobacco

Use Not Applicable.

- Gender. To

define a cost band by gender, select a gender in

the Gender field. When gender

is not applicable to the cost, leave the Gender selection blank on this

record. The

gender of an employee is defined on the Demographics

tab. When there is a cost band for one gender, typically a cost band

with the same code is defined for the other gender code(s) in the system.

- Zip. When

zip code isn't relevant to the cost setup, leave the Zip field blank.

To define cost bands that vary geographically by zip code, enter each affected zip codes in the Zip

field, or define zip codes by range. The band applies to zip codes

equal to or greater than the zip code entered. The zip code from an employee's

primary mailing address on the Employee Master is used as the zip code

for benefit cost bands.

Cost Rules

- Define the Cost

Rules section as needed.

- Banded?

For costs

with cost bands, select the "Banded" option.

- Custom?

The "Custom"

option is reserved for use in setups that have custom-defined cost algorithms

outside the standard system setup. Unless instructed to do so after a

custom program is built, avoid selecting the Custom option.

- Multiple

of Benefit Amt? When

a Cost Band definition sets costs that are multiples of the benefit amount

(such as a life insurance amount), then select the checkbox for "Multiple

of Benefit Amt" and be sure that costs are defined in the non-fixed

columns. This selection can result in significantly overstated benefit

costs if this checkbox is selected and if the benefit cost is not a multiple

of the benefit amount.

- Payroll

Function. When

plans have custom-defined cost algorithms, then the a value for the payroll

function may be provided by the developer of the algorithm.

- Enrollment

Function. When

plans have custom-defined cost algorithms or custom-defined algorithms

for benefit assignment based on other selections in the employee self

service benefit enrollment, then the a value for the enrollment function

may be provided by the developer of the algorithm.

Cost Bands

- Save.

When a

cost band is first added, the record needs to be saved before rows of

bands can be defined.

- Each cost band

has the fields for years, associated costs, and any benefit amount limit

for filtering whether the cost band applies. Use the small icons to add,

edit, and delete these banding records as needed. When you add or edit,

a separate screen opens up to enable defining the values. Since these

are ranges, these do need to be listed in order from the lowest number

of years (as low as 0 in some cases) to the greatest number of years (often

99 and sometimes 150).

Individual bands defined on a Cost Band record

apply to years equal to or greater than the number of years entered. The

Benefit Cost Code defines what years are used and how those years are

calculated.

- Click on Edit to

edit a row, or click on Add to define a new row. Enter cost banding information

for the first band. Enter the demographic factors, associated costs and

any benefit amount limit for the cost band:

- Min Yrs.

Per

band, define the minimum number of years. Often, the first band starts

with a minimum of 0 or 1.

- Max Yrs.

Per

band, define the maximum number of years. The maximum per band is found

in the cost banding tables provided by the benefit carrier or benefits

broker.

- Fixed

EE $. The

employee's fixed annual cost for the benefit according to the defined

criteria. This helps define the employee's cost. Omit this value and leave

it blank if an EE $ is defined.

- Fixed ER $.

The

employer's fixed annual cost for the benefit according to the defined

criteria. This helps define the employer's cost. Omit this value and leave

it blank if an ER $ is defined.

- EE $. The

employee's annual cost for the benefit according to the defined criteria.

This helps define the employee's cost. This

can be a fixed cost or a value that will be multiplied by the benefit

amount.

- ER

$. The

employer's annual cost for the benefit according to the defined criteria.

This helps define the employer's cost. This can be a fixed cost or a value

that will be multiplied by the benefit amount.

- Min Ben Amt.

Enter

any corresponding minimum benefit amount for the benefit according to the defined criteria, especially the

range of benefit amounts is defined per band instead of on the Benefit

Cost code records. This acts to filter out the applicability of this cost

band based on the employee's benefit amount for the associated plan.

Note: Instead of

just limiting the Benefit Amount for the cost band, entering the minimum

and maximum benefit amount can be used to filter out the applicability

of this cost band to Employee Benefit Detail's with Benefit Amounts outside

of the range.

- Max Ben Amt.

Enter

any corresponding maximum benefit

amount for the benefit according

to the defined criteria, especially if the range of benefit amounts is

defined per band instead of on the Benefit Cost code records. This acts

to filter out the applicability of this cost band based on the employee's

benefit amount for the associated plan. For the setup of employee self-service

benefit enrollments, this can also cap the benefit amount assigned through

the self-service benefit enrollment process.

- Edit the banding

information until it defines the next band, and then continue to the next

row. To add additional bands, complete step 10 for the following row,

and repeat until all of the cost bands for the selected benefit and selected

coverage are entered and verified as accurate.

- Save.

If necessary, return to the relevant Benefit Cost Code record,

and select the Cost Band code.

Benefit Cost Band Codes Table